Financial sector drives tax reforms to fuel private sector growth

Truong Ba Tuan, deputy director general of the Department of Tax Policies, Fees, and Charges Supervisory Authority under the Ministry of Finance (MoF), noted that adhering closely to the guidelines of the Party and the state, the MoF has conducted research and a comprehensive review and assessment of tax laws.

|

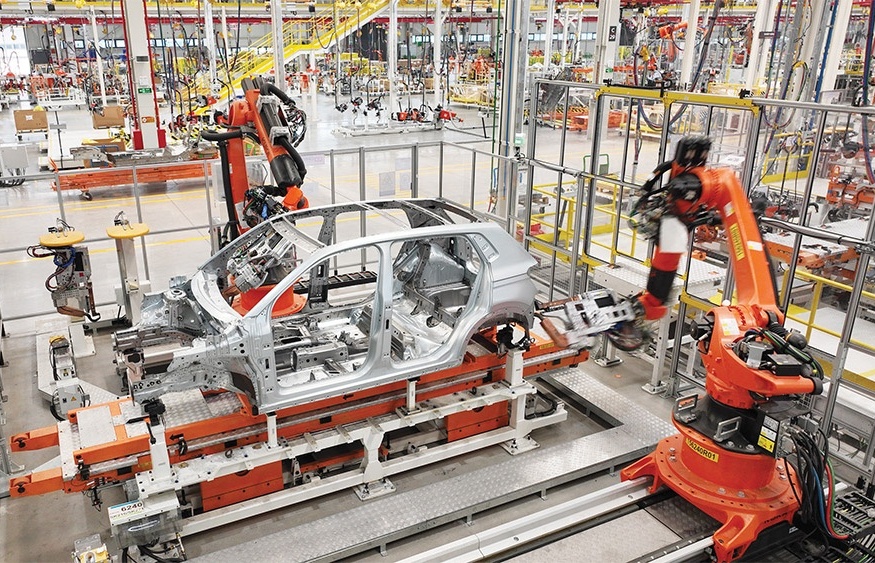

| The financial sector is accelerating tax reforms and administrative procedure simplification to aid the private sector's development |

A report will be submitted for competent authorities to consider tax amendments, with the goal of comprehensively and synchronously supplementing the tax laws within Vietnam’s tax system.

Tuan gave the remark in a talk with the media early this month.

“Leveraging this comprehensive review, the MoF has submitted proposals to the government and the National Assembly (NA) to amend and supplement five key tax laws,” said Tuan.

These include the Law on Value Added Tax which was passed by the NA last November, the amended Law on Special Consumption Tax, and the amended Law on Corporate Income Tax. Both have been presented to the NA for feedback and are expected to be adopted at an NA session this month.

Revisions to the Law on Export and Import Duties are also slated for approval this month, while the replacement of the Law on Personal Income Tax has been proposed for inclusion in the 2025 legislative programme.

According to Tuan, these tax reforms aim to ensure a rational mobilisation of resources for the state budget to fulfill development tasks, uphold social security, and reduce poverty.

At the same time, the updated tax policies are designed to nurture and expand revenue sources for the state budget.

“The tax framework is built on the principle of equality, providing non-discriminatory treatment between different economic sectors, including domestic businesses and foreign-invested companies. It also includes targeted incentives to foster the growth of the private sector,” said Tuan.

Beyond policy development, the MoF has proactively advised the government on implementing a series of tax reduction measures to support business development.

Among these is the preferential corporate income tax rate of 15 per cent or 17 per cent for small firms, compared to the standard 20 per cent rate, aiming to strengthen this critical segment.

Additional measures include tax exemptions on income from the transfer of green bonds, first-time carbon credit transfers post-issuance, and income earned by public service units providing essential services, such as initiatives that contribute to green growth, sustainable development, and social welfare.

The MoF has also reviewed and rationalised preferential tax policies to encourage investment, job creation, technological advancement, innovation, and digital transformation, aiming at furthering national strategic priorities.

Simultaneously, specific tax policies have been introduced to curb the consumption of products harmful to public health or the environment.

On May 4, the Politburo issued a resolution to propel private sector development, laying out numerous tasks and solutions, including the refinement of tax policy.

Tuan revealed that, in response, the MoF quickly developed and submitted a proposal to the government, which led to the NA’s adoption of another resolution on special mechanisms for promoting private sector growth on May 17.

The resolution introduces several new, distinctive tax policies beyond the scope of existing legislation, some of which are being implemented in Vietnam for the first time.

“In addition to policymaking, the MoF has promoted administrative reform to create a more favourable environment for taxpayers, ensuring accurate and sufficient state budget revenue while addressing challenges encountered in implementing tax policies,” said Tuan.

| Resolution 68: Unlocking Vietnam’s private sector A new, sweeping policy directive could mark the most significant shift in the country’s economic orientation since the economic reforms of the 1980s. Richard D. McClellan, founder of RMAC Advisory, has a look at Vietnam's bold vision for private sector development, foreign investment, and more. |

| Private sector vision poised to reimagine real estate A new vision for the private sector in Vietnam highlights the pivotal role of real estate enterprises, a key component in driving development across urbanisation, infrastructure, industry, trade, tourism, and services. |

| Private sector development thrust must be taken seriously Based on the important role of the private sector, Resolution No.68-NQ/TW will be a key driving force for growth, innovation, and integration. The action programme in this term should focus on implementing all solutions and targets in this resolution, to drive all businesses to truly take off and contribute greatly to socioeconomic development. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- ACCA and University of London launch honours pathway for aspiring accountants (June 05, 2025 | 15:30)

- Visa launches new products and partnerships for Asia-Pacific (June 05, 2025 | 10:50)

- Potential new crypto exchange aims to boost blockchain exports (June 04, 2025 | 18:19)

- MoF welcomes BRED Banque Populaire's activities in Vietnam (June 04, 2025 | 15:38)

- VNPAY PhonePOS empowers small merchants to accept international card payments and serve foreign customers (June 04, 2025 | 14:00)

- Australia and Vietnam join forces to boost financial and digital innovation (June 03, 2025 | 17:01)

- GELEX completes international financing transaction worth $79 million (May 30, 2025 | 17:16)

- Banks aim to boost efficiency through listings and capital hikes (May 30, 2025 | 16:36)

- Action ahead on upping fiscal space (May 30, 2025 | 11:06)

- Techcombank voted '#1 Bank in Vietnam' for second consecutive year (May 29, 2025 | 21:02)

Tag:

Tag:

Mobile Version

Mobile Version